How Health Savings Accounts Work

A Health Savings Account is a portable, tax-favored savings account combined with a qualifying high deductible health plan (HDHP) that allows you to fund health care expenses with pre-tax money.

HSAs allow you to avoid federal income tax by saving up to $4,400 for singles or $8,750 for families, into your HSA account. There is no minimum deposit, but whatever you deposit into your account by April 15th is an “above the line” tax deduction for the previous year’s income taxes, and the money is still yours to spend tax free, as long as you spend it on qualified medical expenses.

Reasons HSAs are Better than IRAs

- Pre-tax money is deposited each year into an HSA and can be easily withdrawn at any time with no penalty or taxes to pay for qualified medical expenses. Withdrawals can also be made for non-medical purposes, but will be taxed as normal income and are subject to a 10 percent penalty if done prior to age 65.

- Any HSA funds not used each year remain in the account (no “use it or lose it”), and earn interest tax-free to supplement medical expenses at any time in the future.

- Like an IRA, the account belongs to you, not your employer. But unlike an IRA, your employer CAN contribute to your HSA.

Four Tax Advantages of HSAs

- 100% deductible contributions up to a legally mandated maximum amount

- Money withdrawn for medical spending never falls under taxable income

- Tax deferred interest earnings

- Tax free interest earnings, if money is spent on health care costs

IRS HSA Limits

The maximum funding limits and minimum deductible for HSAs are set by the IRS each year and are as follows:

| Minimum HDHP Deductible | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 |

| Individual | $1,350 | $1,400 | $1,400 | $1,400 | $1,500 | $1,600 | $1,650 | $1,700 |

| Family | $2,700 | $2,800 | $2,800 | $2,800 | $3,000 | $3,200 | $3,300 | $3,400 |

| Maximum HSA Contribution | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 |

| Individual | $3,400 | $3,450 | $3,500 | $3,550 | $3,600 | $3,650 | $4,300 | $4,400 |

| Family | $6,750 | $6,850 | $7,000 | $7,100 | $7,200 | $7,300 | $8,550 | $8,750 |

HSA holders age 55 and older may make additional annual “catch up” contributions of $1,000.

PPO vs HSA Plans

Because HSAs must be paired with a high-deductible health plan, your health insurance premiums are normally much lower than a typical PPO plan with a $500 or $1,000 deductible. The savings from the lower premiums along with the tax-free deductions could be $5,000 or more every year.

However, with an HSA, you may have a higher major medical deductible, and you won’t enjoy office visit and prescription co-pay benefits typical of PPO and HMO plans. Still, for the large majority of consumers, HSAs produce a net financial gain.

Consider these HSA Advantages over PPO Plans:

- Reduced health insurance premium

- Reduced rate of increase in health insurance premium

- Taxable income reduced by HSA deposits

- Out-of-pocket health care expenses paid with pre-tax funds

- Enhanced preventive care benefits

- A new source of long-term savings

Example of HSA Plan Savings

Below is an example comparing how much a typical PPO plan with a $500 deductible and 80% coinsurance might cost, compared to a typical HSA plan with a $3,400 family deductible and 100% coinsurance. This example is based on the average health insurance premium of an individual with a family of four living in Chicago, with $1700 in medical expenses and $450 in expenses for dental care, contacts and eyeglasses. This illustrates the difference in plan costs if the plan holder is in a 28% federal tax bracket, pays the 3% Illinois state income tax, and deposits $4,400, the maximum 2026 family contribution allowed, into his HSA.

| Average PPO Plan | Average HSA Plan | |

| Premium paid (annual) | – $12,100 | – $7,100 |

| Your share of medical expenses |

– $740

$500 deductible

$240 coinsurance

|

– $1,700 |

| Non-covered expenses | – $450 | – $450 dental and eye wear expenses |

| Pre-tax expenses | = – $13,290 | = – $9,250 |

| Federal tax savings | + $0 | + $1,806 ($6450 x .28) |

| State tax savings | + $0 | + $193.50 ($6450 x .03) |

| Net expenses | $13,290 | $7,250.50 |

| Total net savings | n/a | $6,039.50 |

Setting Up a Health Savings Account

You can open a health savings account at any bank or credit union. Most insurance companies offer HSAs through a specific bank they have partnered with, but these banks often charge high service fees.

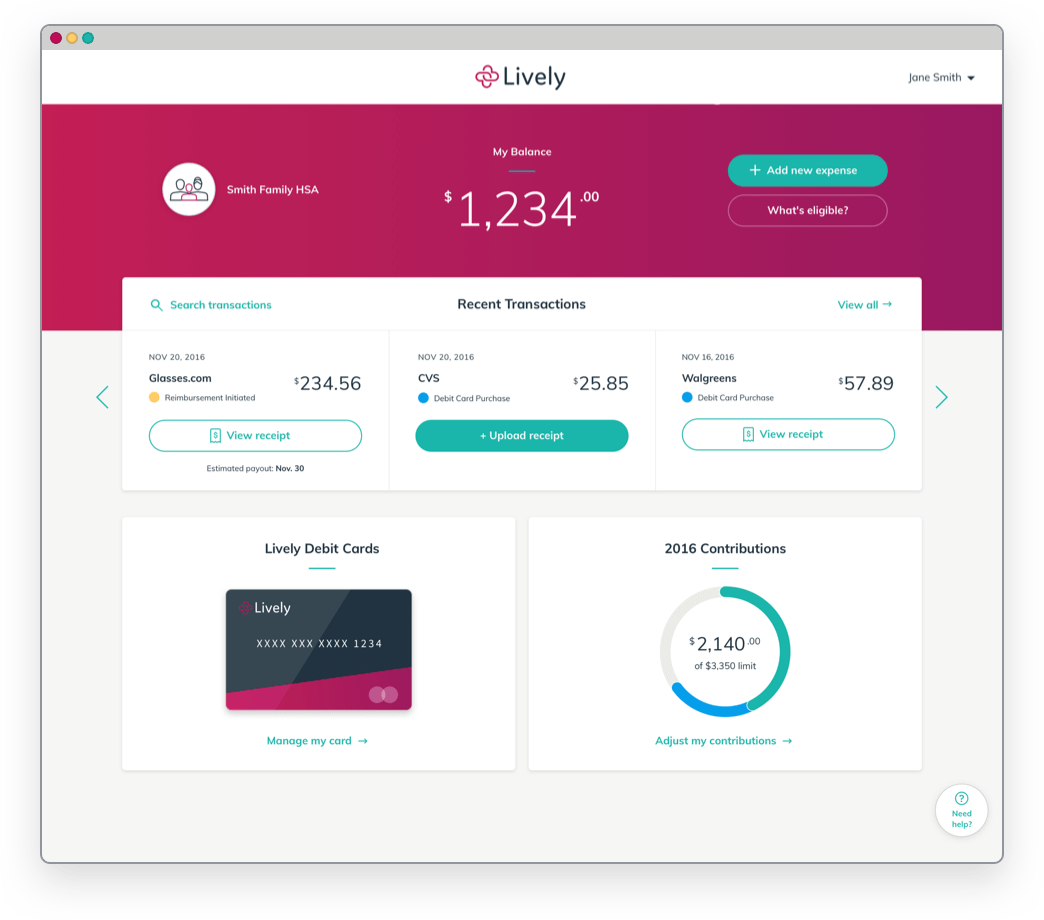

After HSA Enrollment

- An HSA welcome kit that contains all the information about the account and the associated fees

- A debit card, unless requested otherwise on the application

- A sweet online account to manage your HSA account