A provision tucked in President Donald Trump’s proposed budget would give people on Medicare a way to save for health care costs on a tax-advantaged basis.

In the proposal, the White House calls for a new option that would permit Medicare beneficiaries to make tax-deductible contributions to health savings accounts.

- Budget proposal would let Medicare beneficiaries contribute to health savings accounts.

- Retiree healthcare costs could hit $275,000 per couple, excluding long-term care expenses.

That’s a shift from today’s law, as the IRS doesn’t allow those on Medicare to contribute to HSAs, and the proposal offered few details as to how this would work. It’s also unclear whether this provision will be supported in Congress, which ultimately controls the purse strings.

Here’s what the proposal may mean for your ability to pay for retirement health care costs.

Triple-tax savings

Health savings accounts have a triple-tax benefit.

That is, they allow insured individuals to save money on a tax deductible or pre-tax basis. Contributions grow free of taxes, and account holders may make tax-free withdrawals as long as the money goes toward qualified medical expenses.

This year, HSA holders can sock away up to $3,450 if they have single insurance coverage, while those with family coverage may save up to $6,900.

Those over 55 can save an additional $1,000 each year.

It’s unclear what the limits would be for Medicare beneficiaries if adopted.

Unused HSA balances roll over into the following year.

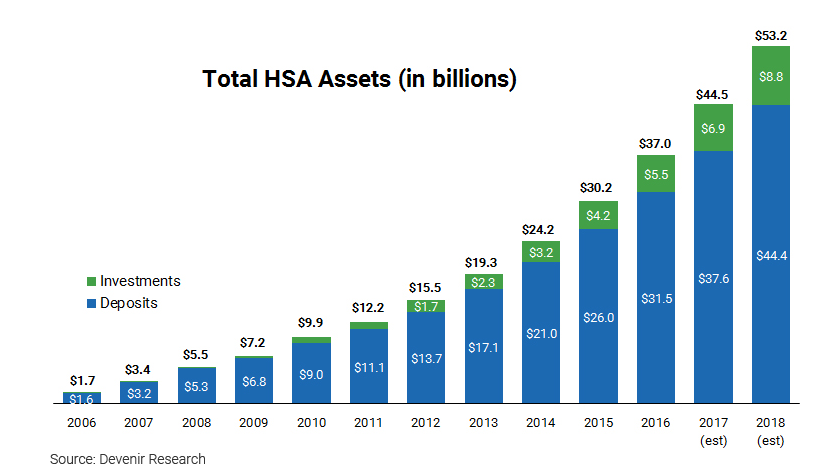

As of 2016, more than 20 million people were enrolled in high-deductible health plans with HSAs, according to America’s Health Insurance Plans, a trade association that represents insurance companies.

HSAs in retirement

While HSA holders who are on Medicare can’t make contributions under current law, they can still tap their savings for qualified medical costs in retirement.

HSA users can leverage their accounts in one of two ways: Either they pull money from the account to cover ongoing health expenses, or they cover those expenses out of pocket and allow the HSA to accumulate over time.

You can strengthen your HSA’s growth potential by contributing to the account over the long term, and investing your contributions into mutual funds or exchange traded funds, if they’re available at your provider.

Given enough time to grow, an HSA can be an additional pot of assets in retirement: You can use them to cover qualified medical expenses, including certain long-term care services.

Consider allowing your account to grow, as a couple’s retirement healthcare costs can run as high as $275,000, according to Fidelity. That figure excludes the cost of long-term care.

Be aware of the consequences that may come up if you die while holding an HSA: If your spouse is the designated beneficiary, then the IRS treats the account as though it belongs to him or her.

If someone else is the beneficiary of the account, then the account is no longer an HSA and its fair market value becomes taxable to the recipient in the year you die.

0 Comments